Content

With time logs and timesheets, companies just take the number of hours worked multiplied by the hourly rate. For information on calculating manufacturing overhead, refer to the Job order costing guide. Note that it is important to include retirement funds, holiday pay, payroll taxes, Manufacturing cost or any additional fees that are incurred by paying direct labor. Some companies may also decide to include costs related to training the production staff. For example, in a furniture manufacturing company, timber, paddings, and textile are the direct materials used in production.

Applying these values to a 1-kW-rated system results in an emissions credit of $993 over a 30-year lifetime. Remember also that calculating costs is only part of value engineering – it does not look at what other design or operational benefits might be achieved. Calculated MSP and manufacturing cost breakdown for a 20MWe geothermal steam turbine in different volumes of manufacturing in the United States. Calculated MSP and manufacturing cost breakdown for a 5MWe ORC turboexpander in different volumes of manufacturing in the United States. Total manufacturing FC system cost versus production rate for 2018, 2020, and 2025. As an example, total cost is expected to decrease to under $40kWnet−1 (about $38.34kWnet−1) for 500,000 units per year in 2025.

Manufacturing Cost Formula

These costs include utilities, rent or mortgage payments, depreciation on equipment, and security. To find the manufacturing cost per unit formula, simply divide the above results by the number of units produced. Many explain manufacturing cost as the cost to bring a product from raw material to the point where it can be sold. If analyzed carefully can be grouped into value-adding costs and non-value adding costs. The value adding costs are essential and cannot be avoided; for e.g. the activities of cutting, stitching, finishing etc., in a garment factory. The non value adding costs can further be analyzed as essentials and avoidable. One cannot avoid all non-value adding costs, as some are essential, like safety measures, meeting the legal requirements etc.

- Like every part of your production process, anticipating these changes helps you stay on top of everything.

- This will help you see if you are underestimating or overestimating your production costs.

- It is important to differentiate between direct materials and indirect materials.

- Splitting up your manufacturing costs into three buckets helps you see where you’re spending too much and where you should invest more.

When you’re ready to start a new project, upload your CAD design files for a free quotation today. Therefore the more perfectly you try to make something, the more you must control both the workpiece and the environment to extreme degrees. For these reasons closer tolerances and higher precision can drive up labor costs substantially and, in fact, don’t necessarily produce a https://online-accounting.net/ better part for most common applications. This is because all raw materials are affected by temperature, humidity, and other environmental conditions. They move and deflect under the pressure of cutting tools and clamping forces. These are fundamental facts of the natural world that cannot be avoided. On a larger scale, these movements are imperceptible and easily accepted.

Understanding the Costs in Product Costs

If the product developer wants to reduce costs while still maintaining quality and performance, then consider relaxing tolerances on areas of the design that are not critical. In the vast majority of cases, modern manufacturing facilities that use quality tools can produce more than acceptable accuracy and precision within their normal range of operations. Some tasks directly affect the fabrication of raw material into a finished or semi-finished product. Depending on the nature of the work being done, these tasks might involve cutting, stamping, gluing, sewing, welding, painting, drilling, molding, assembly, etc. We hope you can put the above suggestions for efficiently managing manufacturing costs to good use in your manufacturing business.

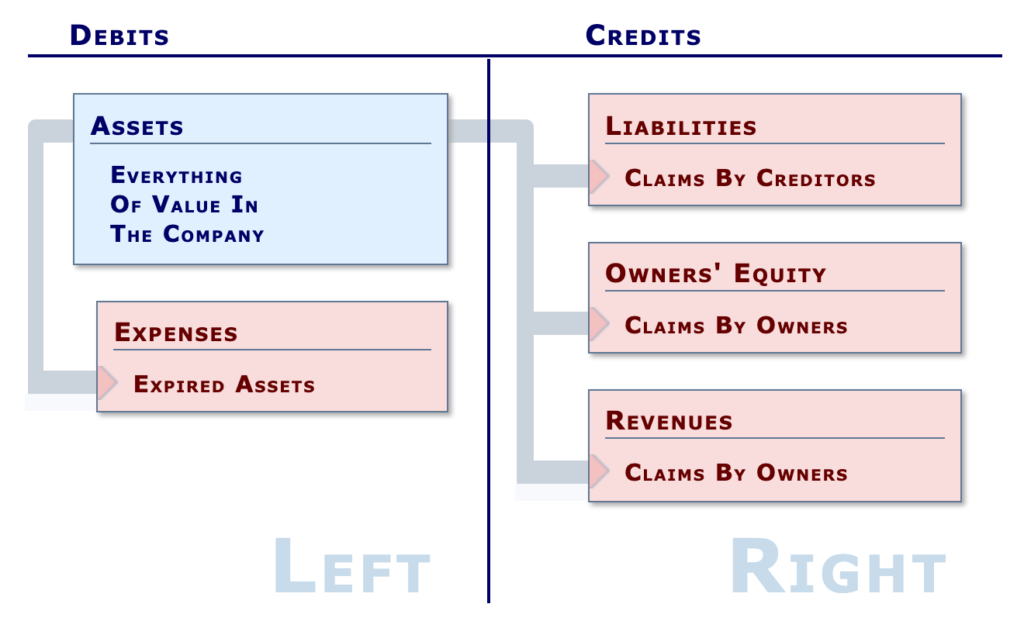

Costs of production include many of the fixed and variable costs of operating a business. Both production costs and manufacturing costs must be included in the calculation of the per-item cost of doing business.

Manufacturing costs definition

They make decisions regarding work they should or shouldn’t take according to the lack of accurate cost information. As mentioned, the Total Manufacturing Cost is used to calculate the Cost of Goods Manufactured and the Cost of Goods Sold, which are essential areas of manufacturing accounting. Once the complete realm of accountants and productivity engineers, the Total Manufacturing Cost has now been revealed as an approachable and useful tool for organizations of all sizes and types. Perhaps you need to go back and reconsider a few areas of your device, before manufacturing. An increasingly popular utility arrangement now adopted by many states is net metering. Net metering allows excess electricity generated during sunlight periods from a privately owned PV system to be used to offset grid-supplied electricity consumed when PV cannot supply sufficient energy.

Indirect overhead costs are special for machinery and equipment, label printing, or factory supplies. Splitting the manufacturing costs into three buckets helps you see where you are overspending and where you must invest more. Manufacturing business owner, you spend a lot of time thinking of the pricing strategies and how to make the manufacturing process more efficient. We’re going to look at what these costs are and how they’re calculated. But more importantly, we’ll focus on ways that product developers can control their costs by exercising smart decisions when it comes to design, materials, and volume. Including too many cost types on a manufacturing cost template may degrade NetSuite performance.

This would normally include aspects like energy bills and rent, as it’s not possible to create items without power or a physical workspace. If sourcing cheaper raw materials ultimately impacts the quality of the products coming off the line, consider looking for deals and arrangements with other suppliers. In fact, several cost-cutting mechanisms streamline the manufacturing process, leading to higher quality products and healthier books of accounts.

What are 3 main types of manufacturing?

When we're talking about the three types of manufacturing we're ultimately referring to, make to stock manufacturing (MTS), make to order manufacturing (MTO), and make to assemble manufacturing (MTA). These three types of manufacturing are rather common among manufacturers.